|

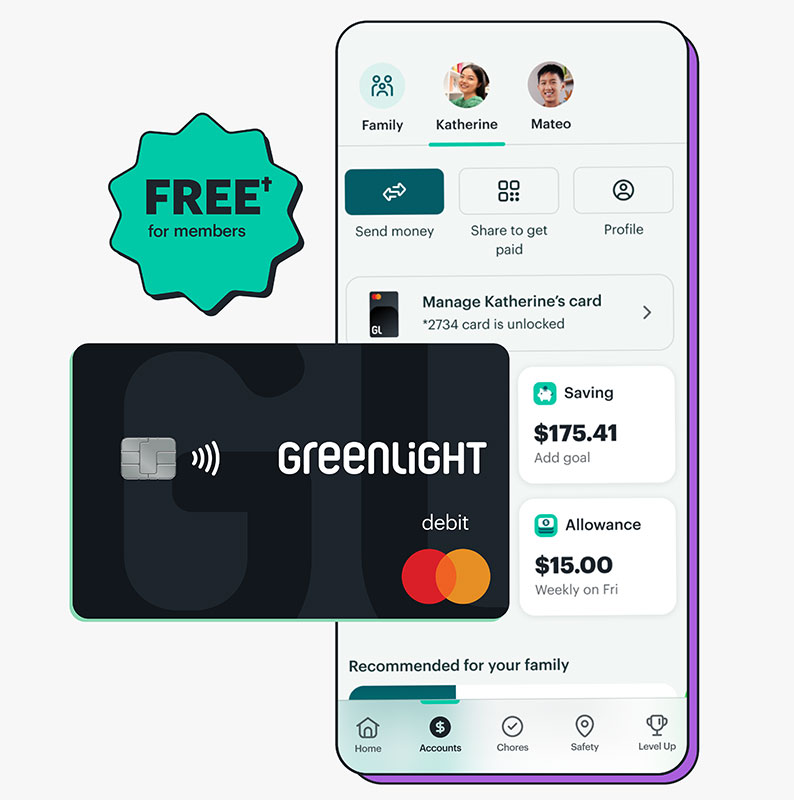

Enjoy Greenlight’s money app and debit card for free.†

Join 6+ million parents and kids learning to earn, save, and spend wisely — together

Get Started

Get your free† Greenlight subscription today.

GreenState members can get the debit card and money app for families for free† through our partnership with Greenlight. To sign up, follow the "Get Started" link above.

A debit card for kids. And so much more.

Money management

Send money quickly, set flexible controls, and get real-time notifications.

Chores and allowance

Assign chores and automate allowance — with the option to connect payouts to chore progress.

Savings goals

Set savings goals for what your kids really want — and watch them grow together.

Financial literacy game

Kids play Greenlight Level Up™, the game that makes money concepts easy to understand and fun to learn.

FAQ

What is Greenlight?

Greenlight is an award-winning money app and debit card that empowers parents to raise financially smart kids. Kids and teens learn to earn, save, and spend wisely – while parents send instant money transfers, set flexible controls, and get real-time notifications.

How much does Greenlight cost?

As a GreenState member, your Greenlight subscription is free†.

What is included in my free† Greenlight subscription?

Your subscription includes debit cards for up to 5 kids, instant money transfers, spending notifications, chores, automated allowance, the financial literacy game Level Up, and more.

How do I access my free† Greenlight subscription?

If you're a GreenState member, you can sign up for your free

† subscription on Greenlight's website at

greenlight.com/greenstate. If you're new to GreenState and/or a current Greenlight customer, you'll find instructions on signing up for your free

† account there, too.

Can I send money to my child’s Greenlight card from the GreenState’s app or website?

No, Greenlight is its own individual app, but within the Greenlight app, you can send money to your child’s card, turn their card on/off, set up spending controls, allowance, chores, and more.

Is there a minimum age to have a Greenlight card?

We support kids and grownups of all ages. No minimum (or maximum) age here. The Primary must be at least 18 years old and a U.S. resident.

Is this a debit or credit card?

Greenlight is a debit card for kids, not a credit card. Parents load money onto the card from their own funding source connected through their Greenlight app. And because it’s a debit card, kids can’t spend what isn’t there. That’s a pretty valuable life lesson.

Is there an app for kids?

Kids and parents will both use the same Greenlight app you see in the app store but have two different experiences and individual login credentials. Parents can set up their child’s login under the child’s profile settings.

Is Greenlight safe?

Greenlight debit cards are FDIC-insured up to $250,000 and come with Mastercard’s Zero Liability Protection. Greenlight blocks ‘unsafe’ spending categories, sends real-time transaction notifications, lets parents turn cards off at any time, and gives parents flexible ATM and spending controls.

The Greenlight card is issued by Community Federal Savings Bank, member FDIC, pursuant to license by Mastercard International.

†GreenState Credit Union members are eligible for the Greenlight SELECT plan at no cost when they connect their GreenState account as the Greenlight funding source for the entirety of the promotion. Subject to minimum balance requirements and identity verification. Upgrades will result in additional fees. Upon termination of promotion, members will be responsible for associated monthly fees. See terms for details. Offer ends 04/04/2027. Offer subject to change or renewal.

Card images shown are illustrative and may vary from the card you receive.